Do

you wonder where the electricity is going to come from for your home and

car of the future?

So

do we.

Do

you wonder how much electricity will cost in the future and if it will

continue to raise the temperature of our Planet?

So

do we.

But

how do we measure what is going on?

AFFORDABLE

CLEAN ENERGY

Clean

affordable energy for all of us on Planet

Earth is a United

Nations sustainable development goal: SDG7.

UN

SUSTAINABILITY DEVELOPMENT GOAL 7: CLEAN

AFFORDABLE ENERGY

Energy

is central to nearly every major challenge and opportunity the world

faces today. Be it for jobs, security, climate

change, food

production or increasing incomes, access to energy for all is

essential. Working towards this goal is especially important as it

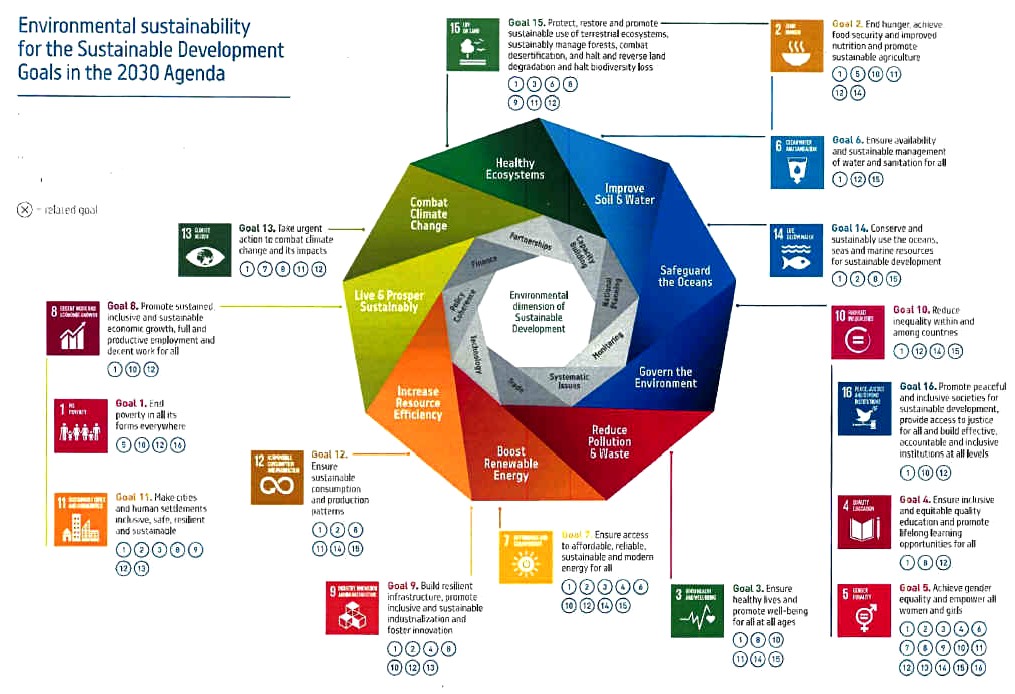

interlinks with other Sustainable Development Goals. Focusing on

universal access to energy, increased energy efficiency and the

increased use of renewable

energy through new economic and job opportunities is crucial to

creating more sustainable and inclusive communities and resilience to

environmental issues like climate change.

At the current time, there are approximately 3

billion people who lack access to clean-cooking solutions and are

exposed to dangerous levels of air

pollution.

Additionally, slightly less than 1 billion people are functioning

without electricity and 50% of them are found in Sub-Saharan Africa

alone. Fortunately, progress has been made in the past decade regarding

the use of renewable electricity

from water, solar

and wind

power and the ratio of energy used per unit of GDP is also

declining.

However, the challenge is far from being solved and there needs to be

more access to clean fuel and technology and more progress needs to be

made regarding integrating renewable energy into end-use applications in

buildings, transport

and industry. Public and private investments in energy also need to be

increased and there needs to be more focus on regulatory frameworks and

innovative business models to transform the world’s energy systems.

There

are several international indices for energy companies that measure how

much clean energy is sold, versus carbon producing (or nuclear waste

producing) energy.

The principle governing the indices, apart from a regional or global focus, is that some focus on clean energy technologies while others focus on the broader alternative energy transition. Other factors which differentiate the indices are whether they:

focus on pure play companies – that is on companies which are principally engaged in the field of alternative energy and excludes those companies for which alternative energy is peripheral to their main business.

use a rule based approach – that is a clearly defined rules-based methodology, usually overseen by an impartial Index Committee, employing a pre-defined screening methodology ensures that the process is consistent and transparent.

are inclusive – that is strives to include all companies that are principally engaged in the field of alternative energy within a given market, a given region, or globally. Some indexes set a liquidity or market capitalization filter while others track just a predetermined number of companies (i.e. the top 15 or the top 20).

Amoco

| British Petroleum | Chevron

| ESSO | Exxon

| Mobil | Shell

GLOBAL ALTERNATIVE ENERGY INDEXES

RENIXX World

The RENIXX World (Renewable Energy Industrial Index) was established in May 2006 and is the first global stock index, which comprises the performance of the world's 30 largest companies of the renewable energy industry whose weighting in the index is based on the market capitalization. Companies must achieve at least 50 percent of their revenue in the renewable energy industry coming from the wind energy, solar power, biomass, geothermal energy, hydropower or fuel cell sector to be included in the index.

Run by International Economic Platform for Renewable Energies (IWR)

ALTEXGlobal

Tracking 138 companies the ALTEX Global is the world's largest Alternative Energy Index with an aggregated market capitalization of $1.16 trillion USD. The focus is on pure play companies involved in the transition to diversified low-emissions energy infrastructure. Sub-sectors tracked are: low-emission utilities, renewables, natural gas, energy minerals, hydrogen, and clean energy technologies. The index is rule based and the constituent list includes the top 25 global companies in all sub-sectors except hydrogen where all companies are included.

Run by Bakers Investment Group

Ardour Global Alternative Energy IndexSM

Tracking 111 companies. The focus is on pure play companies using a rule based approach which is inclusive in the clean energy technologies sector. Companies are involves in the following areas of focus: alternative energy resources (technologies for solar, wind, hydro, tidal, wave, geothermal and bio-energy); distributed generation technologies; environmental technologies including water and air quality; energy efficiency; and, enabling technologies including electronic, batteries, superconductors and advanced materials.

Credit Suisse Global Alternative Energy Index

This index treats alternative energy as a “diversified technology,” according to Credit Suisse. The index comprises 30 companies in five sub-sectors: Natural Gas, Wind, Solar, Bio-energy/Biomass, Geothermal/Hydropower/Fuel cells/Batteries. At the inception date and then at each Rebalancing Date, all five sectors will be capped to 20% to prevent individual sectors from dominating the Index. Stocks selected are major players in their Alternative Energy sectors and/or Alternative Energy activity represents at least 20% of the company’s annual sales.

DAXglobal Alternative Energy Index

The DAXglobal Alternative Energy Index tracks the performance of 15 alternative energy companies. Companies which are selected for the index must generate more than 50 percent of their revenues in one of the following five sub-sectors: Natural Gas, Solar, Wind, Ethanol, Geothermal/Hybrids/Batteries. The DAXglobal Alternative Energy Index has a transparent, rule-based structure. The index comprises three constituents each from five the five sub-sectors, with equal sector weightings. Within each sector, constituents are selected on the basis of market capitalization, and of a minimum average exchange trading volume of USD 1 million.

DB NASDAQ OMX Clean Tech Index

DB Climate Change Advisors, the climate change investment and research branch of Deutsche Bank's asset management business, and NASDAQ OMX Group, Inc created the DB NASDAQ OMX Clean Tech Index. The index comprises 119 companies identified by DBCCA from a global universe of ~4,000, each with at least a third of revenues derived from clean technology within investable geographies and exchanges identified by NASDAQ OMX. Of these, 106 companies have over 50% clean tech revenue, with only identifiable revenue from filed financial statements used for the index. Constituent companies must have market capitalization of at least $250 million as of 12/31/09 and over $1 million average daily dollar trading volume for the three months prior to 12/31/09. Covered sectors include clean energy, energy efficiency, transport, waste management and water.

http://www.dbcca.com/dbcca/EN/products_2286.jsp

S&P Global Clean Energy Index

The S&P Global Clean Energy Index tracks 30 companies from around the world that are involved in clean energy related businesses. The index is based on a diversified mix of Clean Energy Production and Clean Energy Equipment & Technology companies including a number of firms involved in wind and solar. The index uses a rule based approach. The aggregate market capitalization is around US$ 224 billion.

Wilderhill New Energy Global Innovation Index

This index tracks 86 companies that concentrate on renewable energy technologies and processes, with an emphasis on clean power and energy efficiency (the latter including both storage and demand-side

management). The index uses a rule based approach to identify companies active in wind, solar, bio-fuels, hydro, wave and tidal, geothermal and other renewable energy businesses, as well as energy conversion, storage, conservation, efficiency materials, pollution control, emerging hydrogen and fuel cells. Diversification is provided by an equal-weighting methodology modified by sector and market capitalization bands.

World Alternative Energy Index

Run by Société Générale, the Index tracks the 20 largest stocks involved in: Renewable energy (solar, wind and biomass). Energy efficiency (better use of energy generation, which involves industries such as energy meters and superconductors). and Decentralized energy supply (power generation in close proximity to the consumer, involving micro-turbines and fuel cells). WAEX is an equally weighted benchmark, that is the weight of each member is set at 5% on quarterly basis.

FTSE ET50 Index

Designed and launched as the ET50 in 1999 by Impax Asset Management, the index was re-branded the FTSE ET50 in December 2007 after FTSE Group, in partnership with Impax, took over calculation and management. The FTSE ET50 Index measures the performance of the largest 50 companies globally whose core business is in the development and deployment of environmental technologies (at least 50% of their business must be derived from ET). This includes alternative energy, water treatment, pollution control and waste management companies. FTSE has set up an independent committee of clean technology and investment professionals to govern the research and management of the FTSE ET50 Index. The Chair is Winston Hickox, former Secretary of the State of California Environmental Protection Agency who also designed and implemented the environmental investment mandates for the California public employees retirement fund, CalPERS.FTSE Environmental Technology Index Series

FTSE Environmental Opportunities All-Share Index

Aligned with the FTSE ET50 Index, this index measures the performance of a broader basket of over 450 global stocks that have at least 20% of their business derived from environmental markets and technologies. Environmental Technology business activities include alternative energy, water treatment, pollution control and waste management.

Regional Focused Alternative Energy Indexes

ALTEXAustralia

Established October 2006 tracking over 120 companies with an aggregated market capitalization of $52.1 billion AUD. The focus is on pure play companies involved in the transition to diversified low-emissions energy infrastructure. Sub-sectors tracked are: low-emission utilities, renewable energy companies, natural gas, energy minerals, hydrogen, and clean energy technologies. The index is rule based and the constituent list includes all compliant companies on the Australian Stock Exchange.

Run by Bakers Investment Group

Ardour Global Index (EMEA)SM

Tracks 30 companies. A regional index for Europe, Middle East and Asia with the same focus as the Ardour Global Alternative Energy IndexSM.

Ardour Global Index (North America) SM

Tracks 60 companies. A regional index for North America with the same focus as the Ardour Global Alternative Energy

IndexSM.

Italian Renewable Energy Index (IREX)

Run by Althesys Strategic Consultants, the Index tracks 9 Italy-listed small-mid cap companies focused on renewable energy. The index has been established in April 2008. The Index uses a value weighted methodology. In April 2010 the total market capitalisation was € 1.2 billion.

ISE Earth Wind & Fire Index (EWF)

Provides a benchmark for investors interested in tracking companies actively involved in hydrocarbon-free based energy generation. This index tracks 18 US-listed, alternative energy companies involved in hydrogen/fuel cells, solar, wind, hydropower, geothermal, nuclear, battery, utilities, technologies and bio-fuel.

ISE Global Wind Energy (GWE)

Provides a benchmark for investors interested in tracking public companies that are active in the wind energy industry based on analysis of those companies’ products and services.

Ludlow Energy Index

Tracks 30+ alternative energy stocks from US markets focused towards the solar, wind, and bio-fuel markets[10]. The Ludlow Energy Index is privately managed by Ludlow Energy Advisors, LLC. The Index tracks the performance of the Ludlow Energy Index Fund, which invests 70% of its assets equally into free trading common shares of each component within the index, with the remaining 30% reserved to bring new green energy issues public, and to hedge the index gains from any sharp market downturns.

Merrill Lynch Renewable Energy Index

The Index tracks 31 stocks and is intended to provide exposure to stocks likely to benefit from the renewable/alternative energy sector globally. The Index consists of three sub-indices – bio-fuels, wind and solar. The index’s components represent both pure-plays and more diversified firms. The current constituents of the ML Renewable Energy Index selected by Merrill Lynch Research.

Run by Ludlow Energy Ventures, Inc.

NASDAQ Clean Edge U.S. Liquid Series Index

The that are primarily manufacturers, developers, distributors, or installers of clean-energy technologies. An exchange traded fund (ETF) is based on the Index and is sponsored by First Trust Advisors L.P. To be eligible for inclusion in the Index, the security must be listed on NASDAQ, NYSE or AMEX.

Issuers of the security must be classified, according to Clean Edge, as technology manufacturers, developers, distributors, and/or installers in one of the following sub-sectors:

Advanced Materials (nanotech materials, advanced membranes, silicon-based materials and alternatives, bioplastics, etc. that enable clean-energy technologies and/or reduce the need for petroleum-based materials);

Energy Intelligence (conservation, automated meter reading, energy management systems, smart grid, superconductors, power controls, etc.);

Energy Storage & Conversion (advanced batteries, hybrid drivetrains, hydrogen, fuel cells for stationary, portable, and transportation applications, etc.); and

Renewable Electricity Generation & Renewable Fuels (solar photovoltaics, concentrating solar, wind, geothermal, and ethanol, biodiesel, biofuel enabling enzymes, etc.)

WilderHill Clean Energy Index

Tracks the 42 Clean Energy companies on US exchanges: specifically, businesses that stand to benefit substantially from a societal transition toward use of cleaner energy and conservation. Stocks and sector weightings within the WilderHill Clean Energy Index are based on their significance for clean energy, technological influence and relevance to preventing pollution in the first

place. The index has six sub-sectors: renewable energy harvesting; power delivery and conservation; energy storage; cleaner fuels; energy conversion; and, greener utilities. Companies in the Clean Energy Index generally will not have their majority interests in the highest-carbon fuels: oil or coal. Large companies with interests outside clean energy may be included if they are significant to this sector. There is a strong bias in favor of the pure-play companies in wind power, solar power, hydrogen and fuel cells, bio-fuels, and related fields; companies in relevant fields such as hydroelectric, geothermal, wave, tidal, waste heat recapture and others are considered with respect to carbon content, the impacts upon marine and terrestrial biodiversity, and degree to which they advance or reflect the clean energy sector. ECO components are evenly divided within a sector to assign weights.